Introduction:

For hedge fund analysts and asset managers seeking consistent outperformance, understanding the significance of management quality is paramount. In this post, we explore Management Track’s approach, combining predictive executive data, proprietary interviews with former colleagues, and fundamental analysis to generate curated stock calls. These calls serve as valuable case studies, demonstrating the impact of management quality on investment outcomes. With a track record of successful calls, ManagementTrack showcases the potential for leveraging management expertise to achieve long-term investment success.

The Power of Management Quality:

ManagementTrack produces approximately 100 reports each year, with a curated selection of 10 to 15 stock calls based on comprehensive analysis. These calls have not only delivered exceptional value to clients but also serve as compelling examples of the influence of management quality on investment performance. By incorporating insights from interviews, proprietary data, and fundamental analysis, Management Track assesses the unique qualifications of the C-suite in executing a company’s strategy. The performance of these stock calls is evaluated over a two-year period to capture the true impact of executive quality.

Enduring Alpha:

- Since 2018, Management Track has issued a total of 55 long or short calls, achieving an impressive hit rate of 65%.

- This indicates that 65% of the calls either outperformed or underperformed the market, respectively.

- Since 2021, that performance has only increased, with the hit rate improving to 76%.

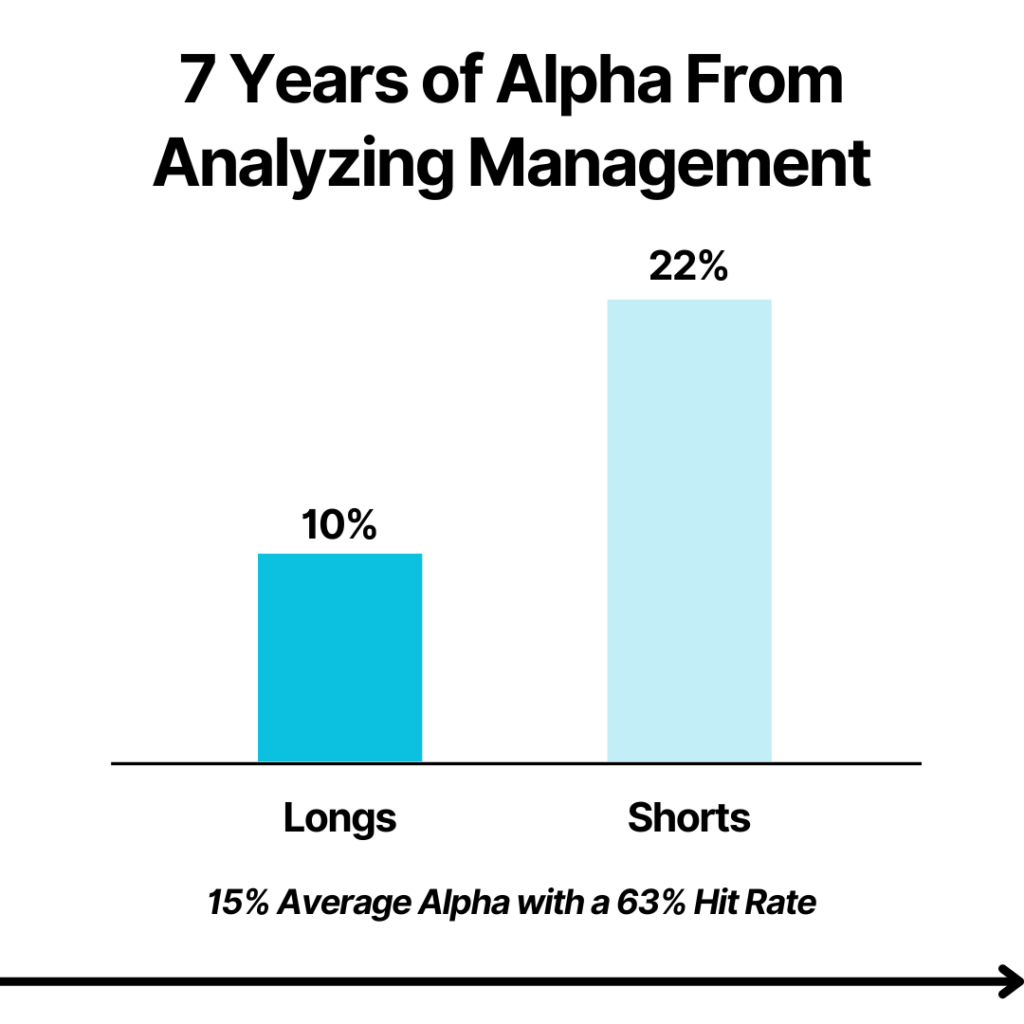

- On the long side, Management Track’s calls have generated an average outperformance of 13% relative to the market across 32 calls.

- Conversely, on the short side, the calls have produced a noteworthy alpha of 20% across 22 calls.

2021 Highlights:

Analyzing Management Track’s performance in 2021 further underscores the effectiveness of their approach. Long calls exhibited an alpha of 19%, while short calls demonstrated an impressive alpha of 30%. The hit rate also improved to 76%, reflecting the consistency of Management Track’s stock calls.

Noteworthy Stock Calls:

Highlighting some of Management Track’s notable stock calls, we observe significant underperformance in shorts over a one-year or longer timeframe:

- Walgreens (45%)

- Intel (51%)

- Six Flags (51%)

- Virgin Galactic (75%)

- Guidewire (93%)

- Sprouts (102%)

On the positive side, for our longs:

- CSX +32%

- ServiceMaster +48%

- Ferrari +51%

- AutoNation +55%

- Tractor Supply +62%

- Resideo +84%

- PG&E +93%

- ON Semiconductor +98%

Conclusion:

ManagementTrack’s stock calls based on management quality have consistently delivered exceptional results for hedge fund analysts and asset managers. By combining predictive executive data, proprietary interviews, and fundamental analysis, ManagementTrack has identified the influence of management quality on stock performance. The impressive performance metrics and notable stock calls underscore the significance of leveraging management expertise in achieving long-term outperformance. By incorporating similar strategies, hedge fund analysts and asset managers can enhance their investment decisions and generate superior returns for their clients.