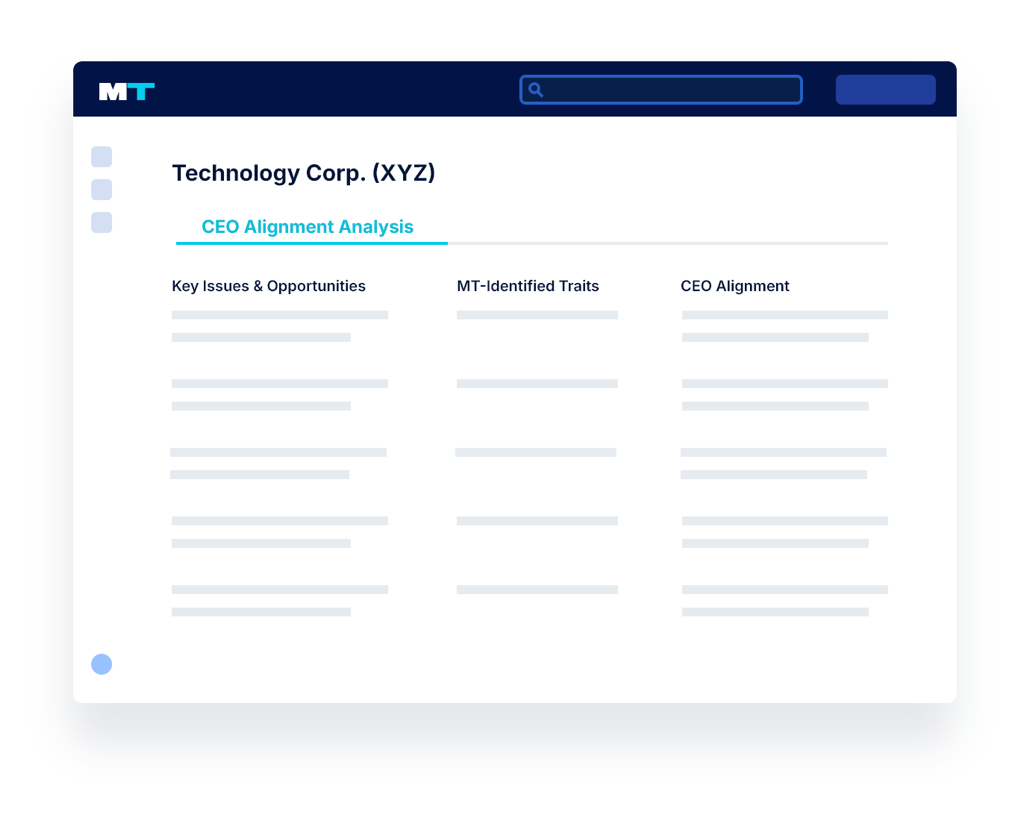

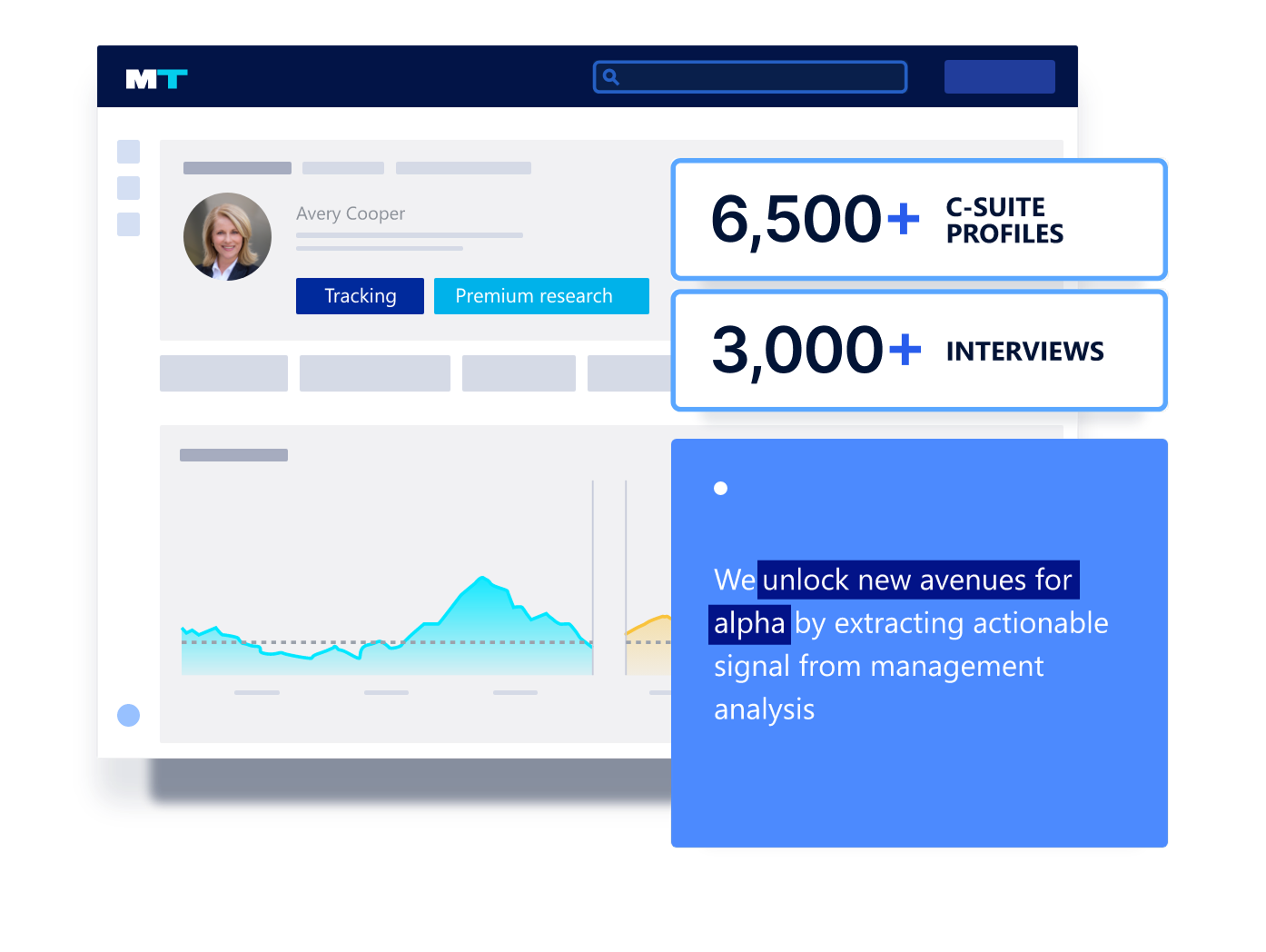

Access real-time analysis of how each CEO’s track record and skillset does or does not align with the most pressing needs of their company.

Based on ManagementTrack’s proprietary memos, interviews, and career analysis data.

Available on over 2,000 public companies.

Access proprietary transcripts of conversations with high-level former colleagues of executives: analyze past initiatives, strengths, & weaknesses. Plus memos that map an executive’s ability to their current company situation. Run by our team of investigation journalists and buy-side analysts who assemble reports on 125+ executives a year

LEARN MORE

Data

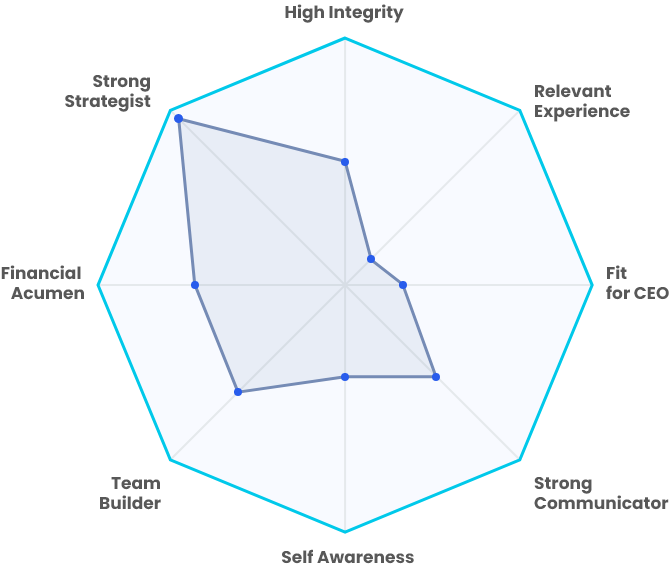

DataInvestors can access a comprehensive career analysis of 6,500+ public company executives. Analyze each executive’s experience, skillset, and fit for their current company. Receive flags of outlier, predictive activity across insider transactions, earnings call evasion, and more.

14 of the top 20 hedge fund and asset managers already use ManagementTrack’s predictive management data and proprietary interviews as a key part of their process.

LEARN MORE

All our executive diligence goes through them now. Their sources and interviews are meaningfully better.

Paragon saved us on a Top 10 position by convincingly outlining the new CEO’s unsuitability for the task ahead.

ManagementTrack’s data and insights have supercharged the management portion of our theses.

All our executive diligence goes through them now. Their sources and interviews are meaningfully better.

Paragon saved us on a Top 10 position by convincingly outlining the new CEO’s unsuitability for the task ahead.

ManagementTrack’s data and insights have supercharged the management portion of our theses.

Access predictive scores and positive and negative calls based on management's ability to execute, providing continual, uncorrelated alpha to clients.

C-suite changes can be a massive disruption to your portfolio - instantly know who they are, what they've done, and how they will impact the company going forward.

Quantitative and qualitative data combines like never before to create alpha-rich insights investors can't find anywhere else.